Hicks & Associates Insurance and Financial Services LLC.

The Medicare Lady

Knowing your rights and what’s available to you can make all the difference to your health and your family.

New Medicare changes for 2026

In 2026 a new payment option is available to help you manage your out of-pocket drug costs by spreading them across the calendar year. (January-December)

The

Part A hospital deductible for 2026 is

$1,736.

After 60 days the daily amount is

$434 per day for days 61-90. After 90 days the Lifetime reserve amount is

$868 per day. Skilled Nursing Facility Coinsurance from days 21-100:

$217 per day.

The Part B annual medical deductible is $283

Medicare Part B monthly premium is $202.90

Part D deductible may be 0-$615

Coverage Gap is eliminated. Yearly out-of-pocket drug costs are capped at $2,100. Once it's reached there is no copay for the rest of the year.

To clear up the confusion and to help you find out your eligibility for Medicare, we schedule frequent Medicare educational workshops that allow attendees to learn without any intimidation or coercion. Just check the schedule for the next event.

Turning 65 can be an exciting time! Let us help you learn the system so that plans such as Medicare Advantage, Medicare supplement, and prescription drug coverage will make your life easier. We look forward to helping you improve your health by taking the stress out of your health insurance.

Life insurance has many purposes. Please reach out to us before setting up a Life Insurance Exam and we will ensure you have all the information you need to make the right decision. Medicare does not cover dental or vision. If you need these services we can help!

We also make available a financial seminar called, Positioning Yourself to Win the Money Game. Based on LaVone’s book, Who Wants to Be A Millionaire-Life Lessons Learned, this session informs one on budgeting, quicker debt reduction, choosing the right insurance, and planning for a successful retirement. You may purchase the book on Amazon

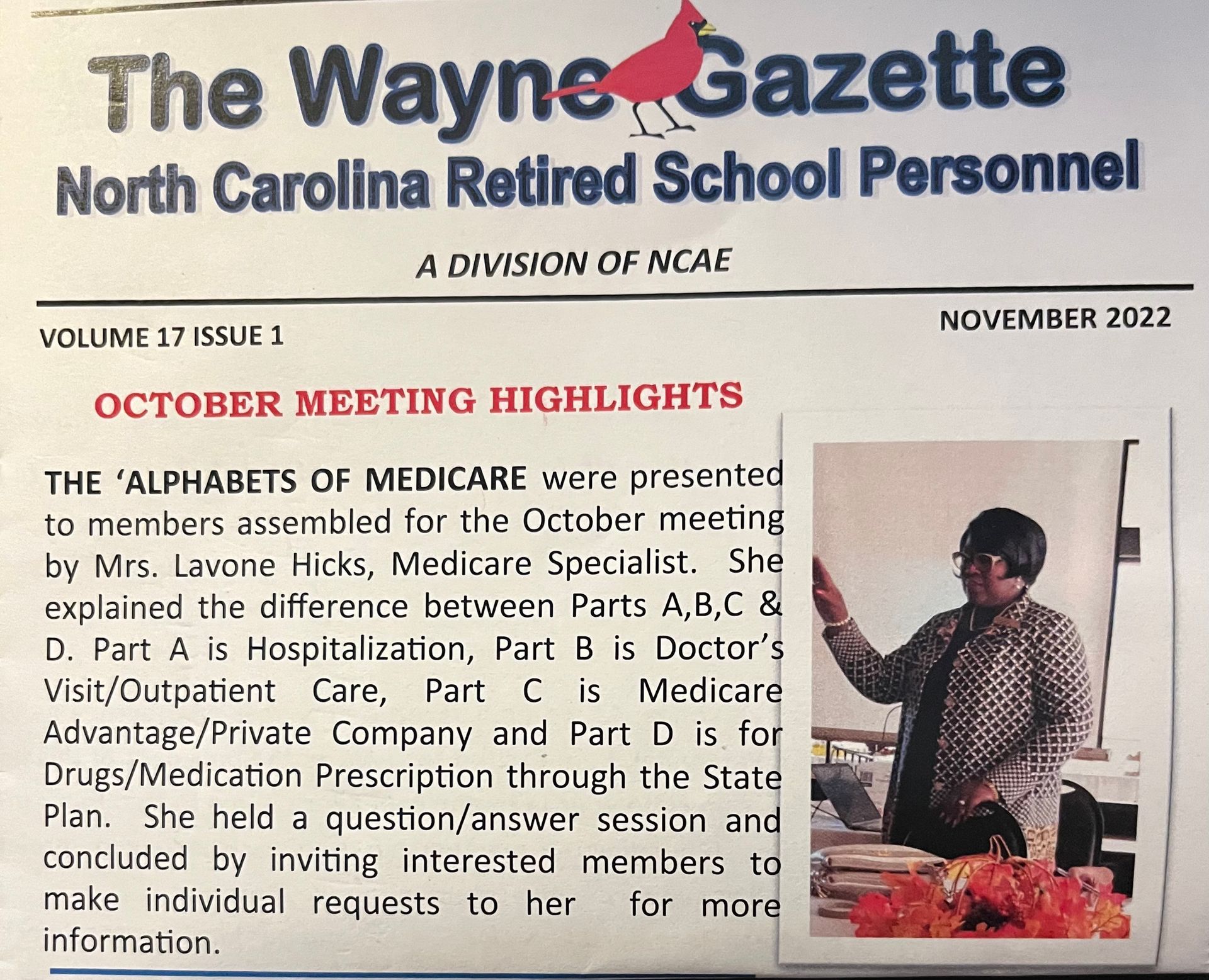

Presenting a Medicare Educational Workshop to interested state retirees!

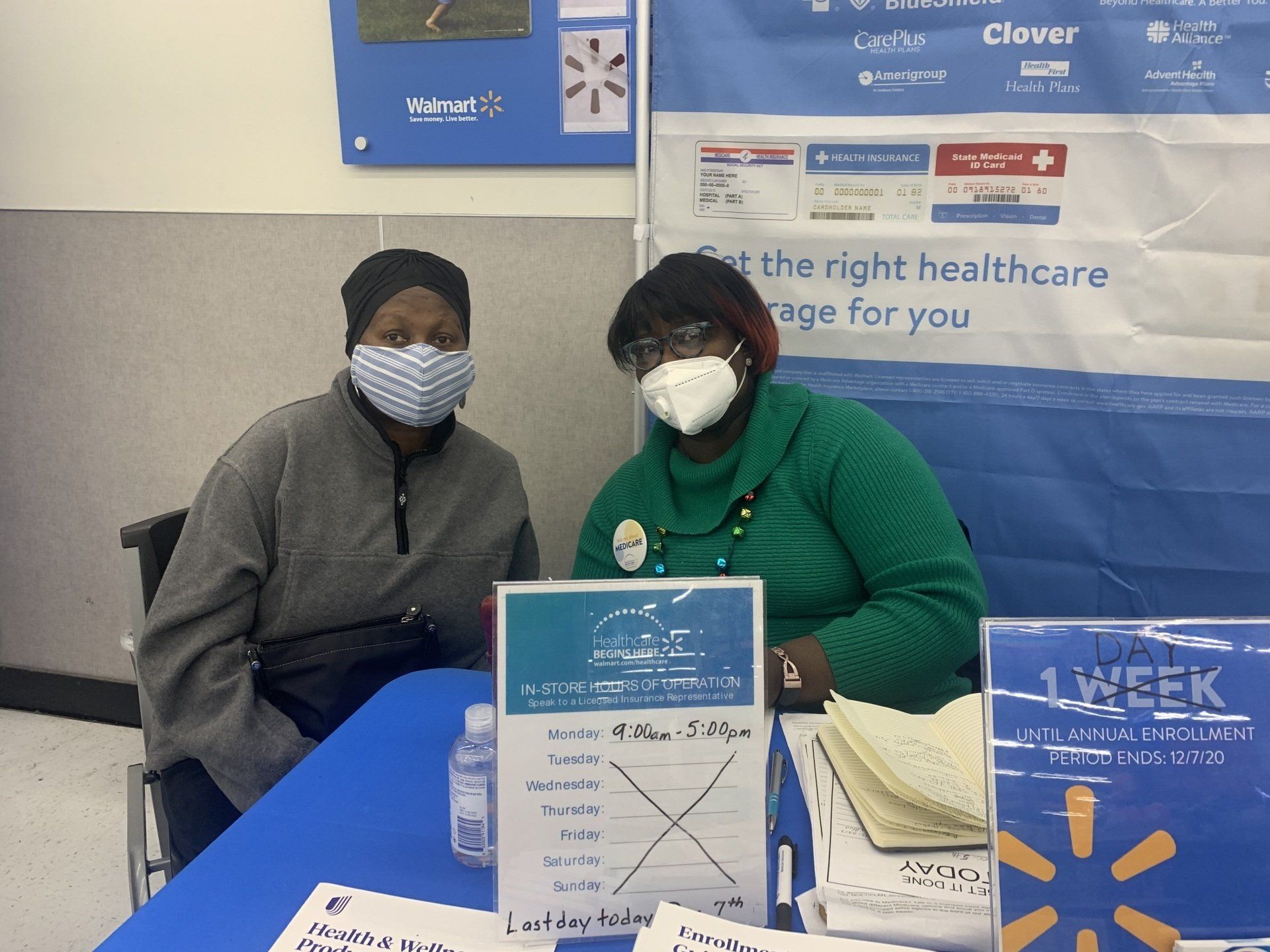

Another satisfied client of The Medicare Lady.

About Us

It's important for seniors to know their rights when it comes to Medicare, but these rights can be very hard to understand. Here at HICKS & ASSOCIATES Insurance and Financial Services LLC, we can help you navigate this tricky process by offering workshops that educate people turning 65 or who are new to Medicare, on the ins and outs of Medicare and other insurance options. We serve seniors and all ages in Raleigh, Goldsboro, and all of North Carolina.

As a brokerage, we can help you shop for the best value for insurance. We will review your plan on an annual basis to ensure you're still getting all that you need at the right value.

In business for more than 20 years, we offer personalized financial services such as life insurance, annuities, dental, and vision, but focus mainly on Medicare.

Providing Information on Personalized Life Insurance in Goldsboro, NC

Hicks & Associates Insurance and Financial Services LLC. has been helping seniors navigate the Medicare and insurance processes for 20+ years. Knowing your rights and what’s available to you can make all the difference to your health and your family.

Personalized life insurance is one of the most important investments you can make, especially if you have dependents. Should something happen to you, the insurance will keep supporting your family, preserve your home, cover funeral expenses, and pay off debts. You can even use it to support your favorite charities. We’re happy to explain the differences between whole and term options to help you find an ideal solution.

Budgeting Advice From an Expert

We make available a financial seminar called, “Positioning Yourself to Win the Money Game.” Based on LaVone’s book, “Who Wants to be a Millionaire: Life Lessons Learned,” attendees learn about budgeting, quicker debt reduction, choosing the right insurance, and planning for a successful retirement. You can buy the book at Amazon and bring our personalized financial services presentation to your church, community event, or civic meetings.

About the Author

LaVone Hicks doesn't have your typical financial background. She’s taught music for 34+ years and has been an insurance agent for nearly 30 years. A graduate of Johnson C. Smith University, she obtained a Master’s in Education from UNC-Charlotte. She’s passionate about empowering others to become financially literate and take control of their lives.

Her book is a self-help guide for those living paycheck to paycheck and wanting to get out of the rut. From her experience as an insurance agent and consumer, Hicks has packed this book with do's and don'ts that help readers save money, reduce debt, choose the best insurance, and prepare for a successful retirement. The book addresses the financial needs of every life stage, and the author can also address the needs of breadwinners who need personalized life insurance.